Author: admin

Bristol Gate Capital Partners CIO, Izet Elmazi, discusses the current market environment and its impact on our portfolios.

Important Disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

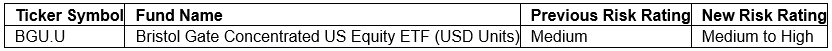

TORONTO, Feb. 25, 2025 /CNW/ – Bristol Gate Capital Partners Inc. (“Bristol Gate Capital Partners”) today announced a change to the risk rating for the USD Units of Bristol Gate Concentrated US Equity ETF (the “Bristol Gate ETF”). This change will be reflected in the applicable ETF Facts and the simplified prospectus for the Bristol Gate ETF as part of the renewal of the simplified prospectus, which final simplified prospectus is expected to be filed on or around February 28, 2025.

The risk rating change set out in the table below is based on the standardized risk classification methodology mandated by the Canadian Securities Administrators and an annual review conducted by Bristol Gate Capital Partners to determine the risk level of the Bristol Gate ETF.

Effective immediately, the risk rating for the Bristol Gate ETF has changed as set out below:

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds (ETFs). Before investing, investors should carefully read the prospectus and ETF facts and carefully consider the investment objectives, risks, charges and expenses of the Bristol Gate ETF. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated.

For a summary of the risks of an investment in the Bristol Gate ETF, please see the specific risks set out in the simplified prospectus. All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk rating is based on how much the ETF’s returns have changed from year to year, based on the volatility of the ETF using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile the ETF will be in the future. The rating can change over time. An ETF with a “low” risk rating can still lose money.

About Bristol Gate Capital Partners Inc.

Bristol Gate Capital Partners is an independent, employee-owned, Toronto-based investment management company serving individual and institutional clients. The firm uses predictive machine learning in combination with fundamental analysis to identify high quality companies that have the capacity and willingness to significantly increase their dividends in the year ahead. Bristol Gate Capital Partners currently manages $3.5 billion in AUM/AUA across a US equity strategy and a Canadian equity strategy and manages an ETF following each strategy. To learn more information, please visit www.bristolgate.com.

For this and more complete information about the Bristol Gate ETF call 416-921-7076 or visit www.bristolgate.com for the prospectus and ETF facts. Copies of the prospectus and ETF facts are also available on www.sedarplus.ca.

For more information, please contact: Michael Capombassis, President, 416-921-7076 x 248, mike.capombassis@bristolgate.com

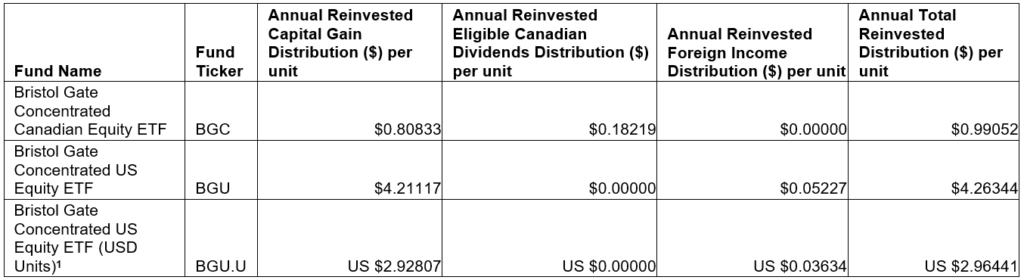

Bristol Gate Capital Partners Inc. Announces Final Annual Reinvested Distributions for Bristol Gate ETFs

TORONTO, Jan. 27, 2025 /CNW/ – Bristol Gate Capital Partners Inc. (“Bristol Gate Capital Partners” or the “firm”) today announced the final annual 2024 reinvested distributions for the Bristol Gate Exchange-Traded Funds (the “Bristol Gate ETFs”).

Unitholders of record on December 31, 2024 received notional distributions representing net investment income and/or realized capital gains within the Bristol Gate ETFs for the 2024 taxation year. A notional distribution is when the units from a reinvested distribution are immediately consolidated with the units held prior to the distribution and the number of units held after the distribution is identical to the number of units held before the distribution.

The taxable amounts of reinvested distributions for 2024, including tax characteristics of the distributions, will be reported to brokers through Clearing and Depository Services (CDS) within the first 60 days of 2025. All values are expressed in Canadian dollars, unless otherwise indicated. This information is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for providing such advice.

Details of the per-unit reinvested distributions for the Bristol Gate ETFs are as follows:

1Distribution per unit amount is reported in USD for BGU.U converted as at December 31, 2024

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds (ETFs). Before investing, investors should carefully read the prospectus and ETF facts and carefully consider the investment objectives, risks, charges and expenses of the ETFs. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated. For this and more complete information about the Bristol Gate ETFs call 416-921-7076 or visit www.bristolgate.com for the prospectus and ETF facts. Copies of the prospectus and ETF facts are also available on www.sedarplus.ca

About Bristol Gate Capital Partners Inc.

Bristol Gate Capital Partners is an independent, employee-owned, Toronto-based investment management company serving individual and institutional clients. The firm uses predictive machine learning in combination with fundamental analysis to identify high quality companies that have the capacity and willingness to significantly increase their dividends in the year ahead. Bristol Gate Capital Partners currently manages $3.4 billion in AUM/AUA across a US equity strategy and a Canadian equity strategy and manages an ETF following each strategy. To learn more information, please visit www.bristolgate.com.

For more information, please contact: Michael Capombassis, President, 416-921-7076 x 248, mike.capombassis@bristolgate.com

FOR IMMEDIATE RELEASE

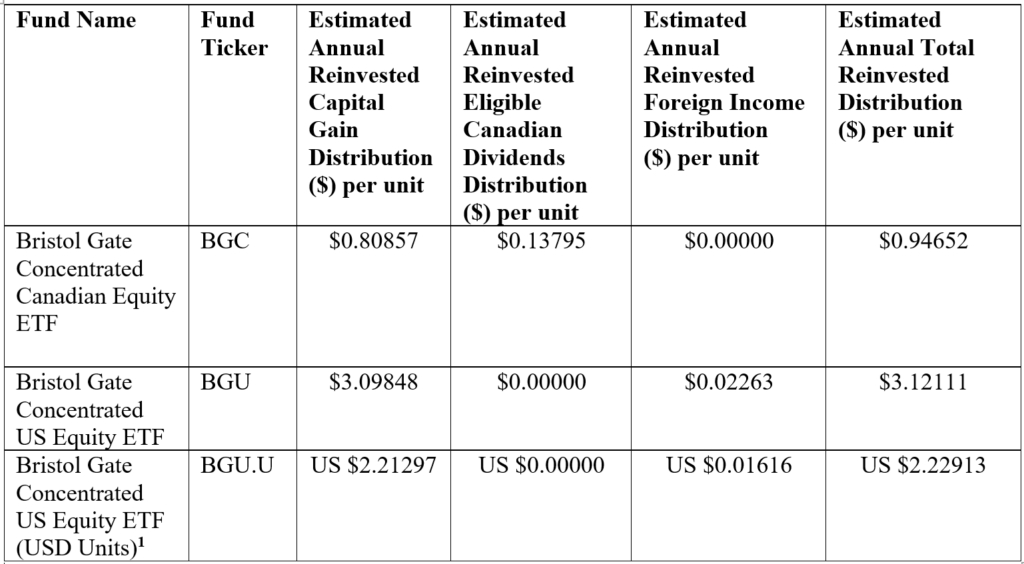

Bristol Gate Capital Partners Inc. Announces Estimated Annual Reinvested Distributions for Bristol Gate ETFs

TORONTO, December 3, 2024 /CNW/ – Bristol Gate Capital Partners Inc. (“Bristol Gate Capital Partners” or the “firm”) today announced the estimated 2024 reinvested distributions for the Bristol Gate Exchange-Traded Funds (the “Bristol Gate ETFs”). These annual reinvested distributions generally represent realized capital gains and/or excess net income within the Bristol Gate ETFs.

The distributions will not be paid in cash but will be reinvested and reported as a taxable distribution. The reinvested distributions will increase the unitholder’s adjusted cost base for the respective ETF. The ex-dividend date for the 2024 annual distributions will be December 31, 2024. Unitholders of record on December 31, 2024 will receive the actual 2024 reinvested distributions which may vary from the estimated amounts disclosed below.

Note that these figures are estimates only, as of November 29, 2024, are not guaranteed and are subject to change prior to the December 31, 2024 taxation year-end of the ETFs.

The actual taxable amounts of reinvested distributions for 2024, including the tax characteristics of the distributions, will be reported to brokers through Clearing and Depository Services (CDS) in early 2025.

All values are expressed in Canadian dollars, unless otherwise indicated. The estimated 2024 annual per-unit reinvested distributions for the Bristol Gate ETFs are as follows:

1-Distribution per unit ($) amount is reported in USD for BGU.U converted as at November 29, 2024

Certain statements in this document may contain forward-looking statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks and uncertainties, including the risks described in the Prospectus of the ETF, uncertainties and assumptions about the ETF, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events.

Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements made by the ETF. The Manager has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds (ETFs). Before investing, investors should carefully read the prospectus and ETF facts and carefully consider the investment objectives, risks, charges and expenses of the ETFs. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated. For this and more complete information about the ETFs call 416-921-7076 or visit www.bristolgate.com for the prospectus and ETF facts. Copies of the prospectus and ETF facts are also available on www.sedarplus.ca.

About Bristol Gate Capital Partners Inc.

Bristol Gate Capital Partners is an independent, employee-owned, Toronto-based investment management company serving individual and institutional clients. The firm uses predictive machine learning in combination with fundamental analysis to identify high quality companies that have the capacity and willingness to significantly increase their dividends in the year ahead. Bristol Gate Capital Partners currently manages approximately $3.3 billion in AUM/AUA across a US equity strategy and a Canadian equity strategy and manages an ETF following each strategy. To learn more information, please visit www.bristolgate.com.

For more information, please contact:

Michael Capombassis

President

416-921-7076 x 248

mike.capombassis@bristolgate.com

“What’s past is prologue” – Shakespeare, The Tempest

Prudent risk management demands that we try to be aware of as many possible risks that exist in our companies, the market, and subsequently in our client portfolios. Today’s U.S. equity markets have been led by a narrow list of technology stocks which account for an astounding 59% of the S&P 500 return year-to-date. This concentration of return is reminiscent of the New Economy boom of the late 1990s, the PC Era of the 1980s, and other technology booms but with distinct differences. Although today’s price leaders have significantly stronger cash flows than those of the 90s, the growing popularity in passive market exposure through index investing has added another level of potential risk in today’s equity markets.

We believe Bristol Gate has a role to play in any long-term investment portfolio and index concentration may be signaling that it is the right time to add to our unique exposure for a variety of reasons:

- Allocation: Our unique high dividend growth focus is complementary to growth-focused and index strategies.

- Active share: We consistently invest in ideas that are not index-focused, as evidenced by our high Active Share of 87%. This indicates that our portfolio’s holdings differ significantly from those of the benchmark index.

- Performance: Long-term absolute and risk-adjusted metrics show how a dividend growth focused strategy can provide a positive alternative to a mega cap driven market.

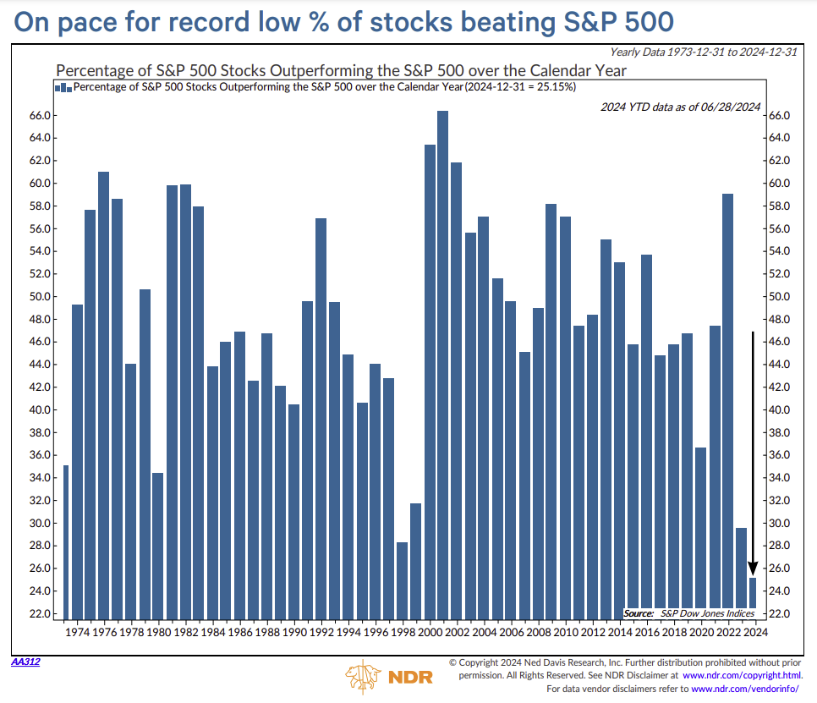

The record low percentage of stocks beating the S&P 500 underscores a stark bifurcation within the market: a few stocks, often grouped together as the “Magnificent 7”, are overwhelmingly driving the broad market’s performance. It is not an exaggeration to state that the narrowness of the current market is unprecedented relative to what we have seen in the last 50 years.

Exhibit 1:

Source: Ned Davis

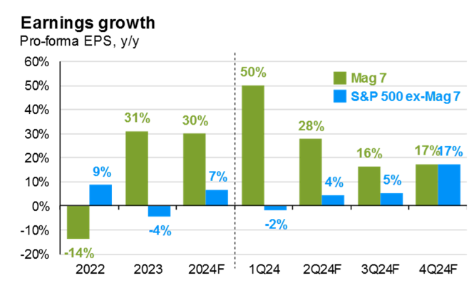

What makes this environment unique from previous markets is that today’s concentration is not centered around hype. The companies driving the market to new highs have delivered staggering earnings growth in an environment of rising interest rates and otherwise muted growth.

Exhibit 2:

Source: JP Morgan Guide to the Markets (July 2024).

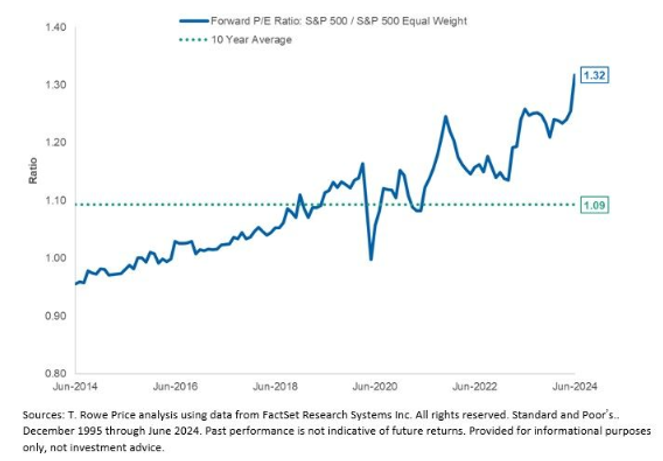

Looking forward, the question for these market leaders is how much of the growth being priced into their stocks is sustainable. On the other hand, are the other 493 companies being fairly valued if an expected broad recovery in earnings growth materializes? Exhibit 3 shows the widening gap between the S&P 500’s performance on a market capitalization weighted basis vs equal weighted basis. This disparity indicates that the largest companies, mostly technology giants, are wielding disproportionate influence over the returns of the index.

Exhibit 3:

Source: T. Rowe Price

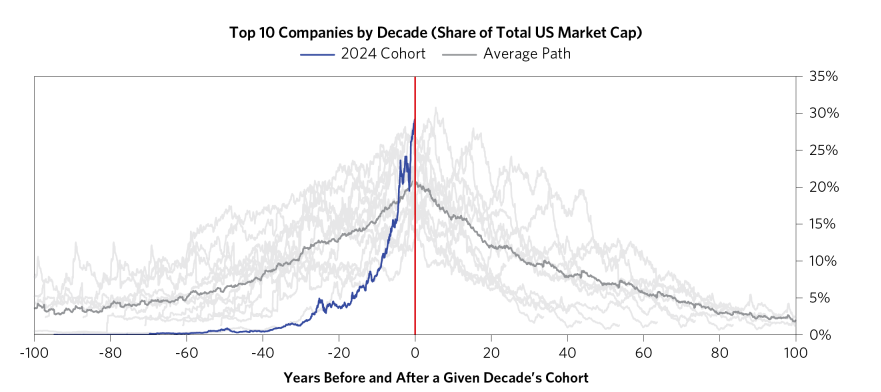

With history as our only guide, we can look back to see how previous instances of companies ascending to such large weights in the index have played out, in terms of concentration and the longevity of that concentration. What we see is that it is unlikely that such levels of concentration last, even as some companies can maintain long periods of dominance.

Exhibit 4:

Source: Bridgewater

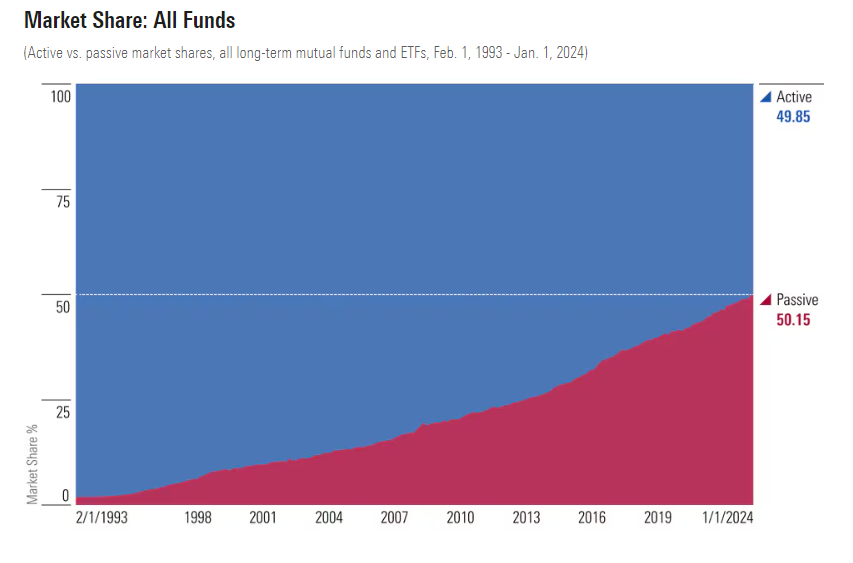

As we indicated earlier, another key difference between the market in the late 1990s is the seismic shift we have seen from active to passive investing. Over the last 30 years, passive funds have gone from less than 2% to today where these funds own over half the market.

Exhibit 5:

Source: Morningstar

This shift exacerbates the concentration issue, as buying into market cap-weighted indices means investors gain a heavy exposure to these few dominant stocks. As a sector, Information Technology has gone from being 18% of the index in 2001 to over 32% today. Owning the market means investors, consciously or not, own a growth portfolio.

In our view, the solution to this concentrated risk is diversification—not through more concentration but through a thoughtful blend of passive and active management. A strategic rebalancing from passive to active strategies allows investors to benefit from the growth of the stocks driving the market. This approach mitigates the dual risks of being over-concentrated in those few names and missing out on the opportunity to invest in broader market segments that may be undervalued.

Bristol Gate’s focus on high dividend growth offers an exposure to high-quality companies beyond the largest companies. Our US Equity portfolio boasts an Active Share of over 87%, meaning an allocation to our strategy would immediately diversify an investor’s portfolio and reduce exposure to the highest weights in the index.

Owning our portfolio doesn’t require giving up on the most attractive segments in the market. Our portfolio companies all enjoy sustainable tailwinds that are helping drive earnings growth, free cash flow growth, and subsequently dividend growth to us as shareholders:

Exhibit 6:

Source: Bristol Gate Capital Partners

Our portfolio continues to benefit from the vast investments being made in Artificial Intelligence (“AI”) through holdings like Microsoft, Broadcom, Applied Materials, and Microchip Technology, but without owning companies that are trading at nosebleed valuations. Active management benefits from under-recognized fundamentals, a case we believe exists right now. By adjusting allocations away from the most overvalued stocks, investors can safeguard against potential downturns and capitalize on growth opportunities across the wider market.

Important Disclosures: There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements: This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

At Bristol Gate, we are committed to integrating leading-edge technology across our firm. Since the beginning, we have believed in using data management techniques to help predict dividend growth. Our prediction journey began in 2009 with a linear regression model. By 2014, access to advanced technology allowed us to begin applying Machine Learning and since 2017, we have been using Artificial Intelligence (AI) to help generate an analytical edge. Our team of data scientists has a long, successful track record of accurately predicting a company’s future dividend growth, which has given us insight into how AI can successfully be integrated into a fund’s investment process.

With the recent surge in popularity of AI and generative technologies, AI has become a buzzword many firms are using to attract investors. It’s crucial for investors to discern between genuine innovation and mere hype. When evaluating a fund or a company that claims to use AI, consider the following:

1. Ask for the AI Model’s Backtest: The backtest results of an AI model should be separate from the portfolio’s performance. A backtest will show you if the AI model effectively addresses the problem it’s supposed to solve.

2. Inquire About Data Preprocessing: Seek to determine a firm’s data handling process: How do they transform raw data for the model? This process can help reveal the sophistication of their approach.

3. Question the AI Model Fine-Tuning: How a firm fine-tunes a model can indicate their commitment to maintaining and improving AI capabilities.

4. Future Roadmap for the AI Model: Continuous improvement is a good sign of a firm’s dedication to leveraging AI effectively and the plans for the model should show this.

5. Model Explanation and Transparency: A reputable firm should be able to explain how their AI model makes its decisions. This transparency is crucial for trust and understanding the model’s reliability.

As you navigate the investment landscape, it’s essential to discern the real AI-driven opportunities from the hype. At Bristol Gate, we pride ourselves on our authentic application of AI. Our approach is about more than just using technology; it’s about intelligent integration to create real value for our investors.

Important Disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

FOR IMMEDIATE RELEASE

Bristol Gate Capital Partners Inc. Announces Final Annual Reinvested Distributions for Bristol Gate ETFs

TORONTO, January 9, 2024 /CNW/ – Bristol Gate Capital Partners Inc. (“Bristol Gate Capital Partners” or the “firm”) today announced the final annual 2023 reinvested distributions for the Bristol Gate Exchange-Traded Funds (the “Bristol Gate ETFs”).

Unitholders of record on December 29, 2023 received notional distributions representing net investment income and/or realized capital gains within the Bristol Gate ETFs for the 2023 taxation year. A notional distribution is when the units from a reinvested distribution are immediately consolidated with the units held prior to the distribution and the number of units held after the distribution is identical to the number of units held before the distribution.

The taxable amounts of reinvested distributions for 2023, including tax characteristics of the distributions, will be reported to brokers through Clearing and Depository Services (CDS) within the first 60 days

of 2024. All values are expressed in Canadian dollars, unless otherwise indicated. This information is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for providing such advice.

Details of the per-unit reinvested distributions for the Bristol Gate ETFs are as follows:

| Fund Name | Fund Ticker | Annual Reinvested Capital Gain Distribution ($) per unit | Annual Reinvested Eligible Canadian Dividends Distribution ($) per unit | Annual Reinvested Foreign Income Distribution ($) per unit | Annual Total Reinvested Distribution ($) per unit |

| Bristol Gate Concentrated Canadian Equity ETF | BGC | $0.06682 | $0.15651 | $0.00000 | $0.22333 |

| Bristol Gate Concentrated US Equity ETF | BGU | $0.51570 | $0.00000 | $0.11582 | $0.63152 |

| Bristol Gate Concentrated US Equity ETF (USD Units)1 | BGU.U | US $0.39110 | US $0.00000 | US $0.08784 | US $0.47894 |

1Distribution per unit amount is reported in USD for BGU.U converted as at December 29, 2023

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds (ETFs). Before investing, investors should carefully read the prospectus and ETF facts and carefully consider the investment objectives, risks, charges and expenses of the ETFs. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated. For this and more complete information about the Bristol Gate ETFs call 416-921-7076 or visit www.bristolgate.com for the prospectus and ETF facts. Copies of the prospectus and ETF facts are also available on www.sedarplus.ca

About Bristol Gate Capital Partners Inc.

Bristol Gate Capital Partners is an independent, employee-owned, Toronto-based investment management company serving individual and institutional clients. The firm uses predictive machine learning in combination with fundamental analysis to identify high quality companies that have the capacity and willingness to significantly increase their dividends in the year ahead. Bristol Gate Capital Partners currently manages $2.8 billion in AUM/AUA across a US equity strategy and a Canadian equity strategy and manages an ETF following each strategy. To learn more information, please visit www.bristolgate.com.

For more information, please contact:

Michael Capombassis

President

416-921-7076 x 248

FOR IMMEDIATE RELEASE

Bristol Gate Capital Partners Inc. Announces Estimated Annual Reinvested Distributions for Bristol Gate ETFs

TORONTO, November 24, 2023 /CNW/ – Bristol Gate Capital Partners Inc. (“Bristol Gate Capital Partners” or the “firm”) today announced the estimated 2023 reinvested distributions for the Bristol Gate Exchange-Traded Funds (the “Bristol Gate ETFs”). These annual reinvested distributions generally represent realized capital gains and/or excess net income within the Bristol Gate ETFs.

The distributions will not be paid in cash but will be reinvested and reported as a taxable distribution. The reinvested distributions will increase the unitholder’s adjusted cost base for the respective ETF. The ex-dividend date for the 2023 annual distributions will be December 28, 2023. Unitholders of record on December 29, 2023 will receive the actual 2023 reinvested distributions which may vary from the estimated amounts disclosed below.

Note that these figures are estimates only, as of November 16, 2023, are not guaranteed and are subject to change prior to the December 31, 2023 taxation year-end of the ETFs.

The actual taxable amounts of reinvested distributions for 2023, including the tax characteristics of the distributions, will be reported to brokers through Clearing and Depository Services (CDS) in early 2024.

All values are expressed in Canadian dollars, unless otherwise indicated. The estimated 2023 annual per-unit reinvested distributions for the Bristol Gate ETFs are as follows:

| Fund Name | Fund Ticker | Estimated Annual Reinvested Capital Gain Distribution ($) per unit | Estimated Annual Reinvested Eligible Canadian Dividends Distribution ($) per unit | Estimated Annual Reinvested Foreign Income Distribution ($) per unit | Estimated Annual Total Reinvested Distribution ($) per unit |

| Bristol Gate Concentrated Canadian Equity ETF | BGC | $0.37271 | $0.11893 | $0.00000 | $0.49164 |

| Bristol Gate Concentrated US Equity ETF | BGU | $0.59657 | $0.00000 | $0.08212 | $0.67869 |

| Bristol Gate Concentrated US Equity ETF (USD Units)1 | BGU.U | US $0.43408 | US $0.00000 | US $0.05975 | US $0.49383 |

Certain statements in this document may contain forward-looking statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks and uncertainties, including the risks described in the Prospectus of the ETF, uncertainties and assumptions about the ETF, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events.

Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements made by the ETF. The Manager has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds (ETFs). Before investing, investors should carefully read the prospectus and ETF facts and carefully consider the investment objectives, risks, charges and expenses of the ETFs. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated. For this and more complete information about the ETFs call 416-921-7076 or visit www.bristolgate.com for the prospectus and ETF facts. Copies of the prospectus and ETF facts are also available on www.sedar.com.

About Bristol Gate Capital Partners Inc.

Bristol Gate Capital Partners is an independent, employee-owned, Toronto-based investment management company serving individual and institutional clients. The firm uses predictive machine learning in combination with fundamental analysis to identify high quality companies that have the capacity and willingness to significantly increase their dividends in the year ahead. Bristol Gate Capital Partners currently manages approximately $2.6 billion in AUM/AUA across a US equity strategy and a Canadian equity strategy and manages an ETF following each strategy. To learn more information, please visit www.bristolgate.com.

For more information, please contact:

Michael Capombassis

President

416-921-7076 x 248

Through the third quarter of the year, it may be easy to forget that the market was solely focused on whether we were about to enter a central bank-induced recession. Instead, coming off the worst year for the S&P 500 since 2008, the market has shrugged off rising rates, inflationary headwinds and the lackadaisical corporate revenue and earnings growth to deliver strong returns.

In particular, a small subset of stocks, colloquially known as “the Magnificent Seven”[1] have contributed the lion’s share of the index’s returns this year. After a challenging year for technology stocks and the enthusiasm for all things AI, we can appreciate why investors are hungry for the extravagant revenue and earnings growth numbers these businesses have delivered. We have previously discussed how we believe we’re responsibly investing in companies that are poised to benefit from the long-term secular growth trends due to the significant investments being made in Artificial Intelligence.

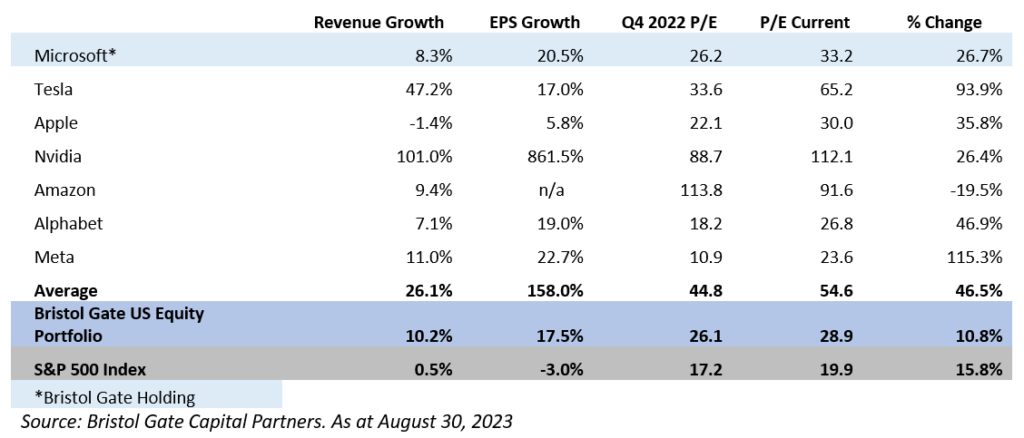

Given the spotlight on these companies, however, it is prudent to emphasize that their valuation multiples have adjusted accordingly:

Exhibit 1: Revenue and EPS Growth and Change in P/E from Q4 2022 to Q2 2023

As bottom-up investors we are required to look to the future when evaluating potential investments with our client’s capital. Too often when companies trade at lofty valuations it is due to, at best, overly optimistic and, at worst, unrealistic projections for future growth. While not bargain hunters, our approach focuses on being confident that we don’t overpay for a business. We keep in mind the old investing adage that a great business can be a poor investment if you pay too much for it.

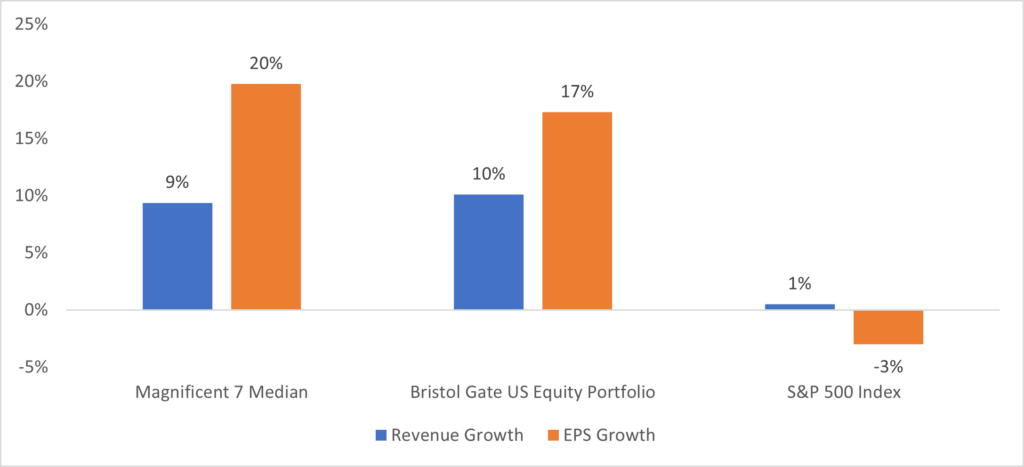

In our view, despite their impressive short-term growth trajectories, the current valuations for some of these companies leave little room for error. Any speedbump in delivering on those rosy growth assumptions represents significant risk. In contrast, we feel our US Equity strategy is much more reasonably priced while delivering vastly superior revenue and earnings growth relative to the market – with fundamental results that are in line with the Magnificent Seven.

Exhibit 2: Median Revenue and EPS Growth

Source: Bristol Gate Capital Partners, Bloomberg. As at August 30, 2023.

Every so often, a few companies are given the limelight and become market darlings, but it is rare they can live up to the height of their expectations. Opportunities for long-term investors are those businesses that are being ignored by the masses. Our focus on high dividend growth companies leads us into high quality, growing businesses without nosebleed valuations. For any investor, paying for growth is unavoidable, but why not pay less?

[1] Magnificent Seven Stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Important Disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes