June 27, 2023

Our firm has a rich history of leveraging AI to gain a competitive edge in the market. From the early adoption of sophisticated regressions to the integration of machine learning techniques, our approach has always been driven by an authentic commitment to innovation. In recent months, the publicity around “artificial intelligence” (AI) has grown to new heights and has also captured the attention of investors worldwide.

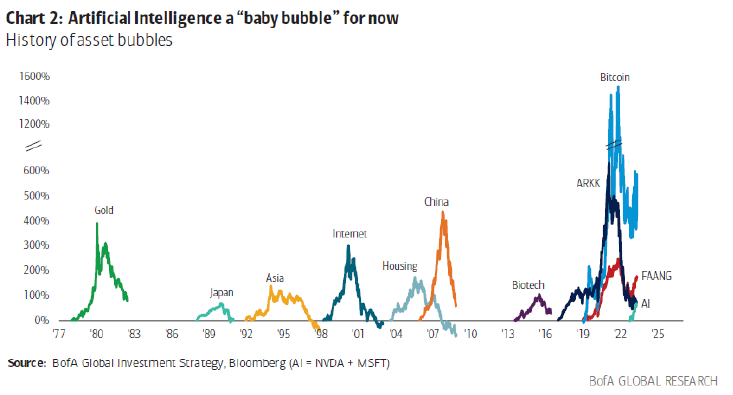

As tends to happen in the market whenever a new technology or innovation gains massive acceptance, investors have an unshakeable habit of rushing into any and all associated investments without any discernment for valuation or business quality. We have seen this play out repeatedly through history:

Exhibit 1:

Source: Bloomberg, BofA Global Investment Strategy

Despite only owning 22 stocks in our US Equity strategy, our unique approach to dividend growth investing allows us to own businesses that yield-focused investors might miss, including in the technology and semi-conductor space. We believe our portfolio offers our investors high quality exposure to the developments in AI through four stocks in particular (as of June 26th, 2023):

- Applied Materials (YoY*[1] Dividend Growth: +23.1%): The company is the largest manufacturer of wafer fabrication equipment that will benefit from the increasing size and complexity of AI chips and the significant investments their customers are making to produce them. Applied will be providing chip manufacturing equipment to logic/foundry and memory suppliers to produce the chips required to power these AI workloads.

- Broadcom (YoY Dividend Growth: +9.5%): Broadcom’s networking components help direct traffic between data centre servers, and its custom chips power AI workloads for some of the biggest cloud computing providers. Management has said that its AI-related sales could double in coming quarters as companies scramble to compete in generative AI.

- Microchip (YoY Dividend Growth: +38.8%): Three megatrends, including AI, data centres and autonomous driving have been and will continue to be significant contributors to Microchip’s growth. MCHP’s data center segment is the largest at 17.5% of sales, up from 14.2% just two years ago. Overall, Microchip’s high-growth megatrend segments have grown from 34% to 45% of the business in just two years, growing at two times the rate of the overall company.

- Microsoft (YoY Dividend Growth: +9.7%): A leading hyperscale cloud provider that will benefit from the significant processing power required to handle AI workloads. Additionally, on the back of the success of Chat GPT extended its partnership with a $10bn investment in OpenAI and kicked off a generative AI arms race.

[1]YoY dividend growth: Latest quarterly dividend relative to same period last year

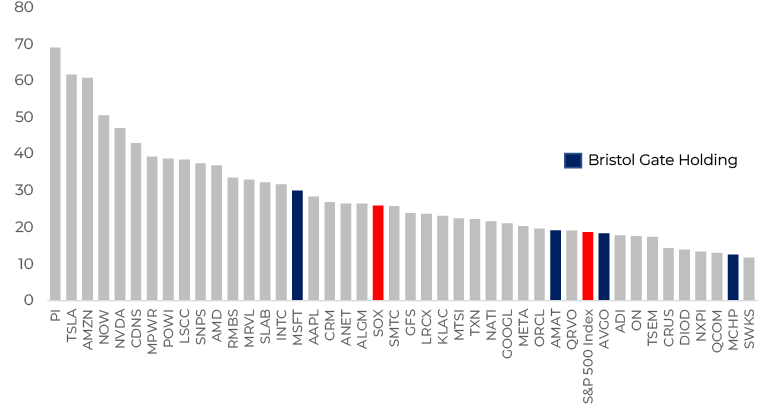

In addition, we believe our holdings are more reasonably priced and less exposed to valuation risk than many of the semi-conductor and technology companies that have seen share price increases due to perceived AI-tailwinds:

Exhibit 2: 12 Month Forward P/E Ratios:

Source: Bloomberg, Bristol Gate Capital Partners

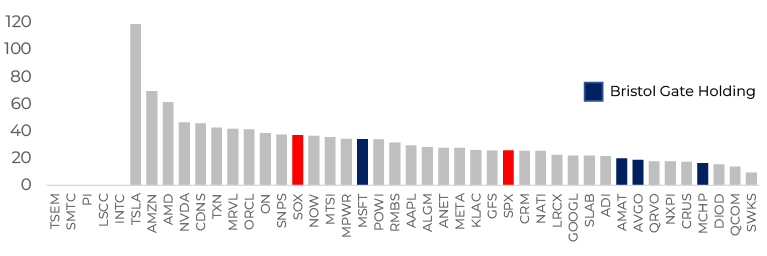

Our firm’s focus on predicting and identifying high dividend growth companies stems from the underlying belief that within that universe are high quality companies that are growing their earnings at extraordinary rates, which the dividend growth serves as a proxy for. However, we want to own businesses with true earnings power, which translates to companies that earn and can grow their free cash flow. On a cash flow basis, those same companies are also trading at less frothy levels relative to others on the back of the interest in AI:

Exhibit 3: 12 Month Forward EV/FCF

Source: Bristol Gate Capital Partners, Bloomberg, Zacks. As at June 5, 2023

We strive to strike a balance between the art and science of investment, recognizing that human insight and expertise play a crucial role in navigating complex financial landscapes. We recognize that AI is not a magical solution, but if the investment opportunity is navigated intelligently, we believe the companies we own can offer long-term exposure that will benefit our clients and partners.

Important Disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes