BRISTOL GATE’S ESG INTEGRATION FRAMEWORK

OUR COMMITMENT

We do things differently — always with the same pursuit of quality and ensuring our own company reflects the values we think make companies and people better together. We believe great companies consider all their stakeholders – customers, employees, shareholders, and the communities they operate in – when making business decisions. We look for companies that generate sustainable and growing income for our investors by mitigating investment and business risks associated with environmental, social, economic and governance issues.

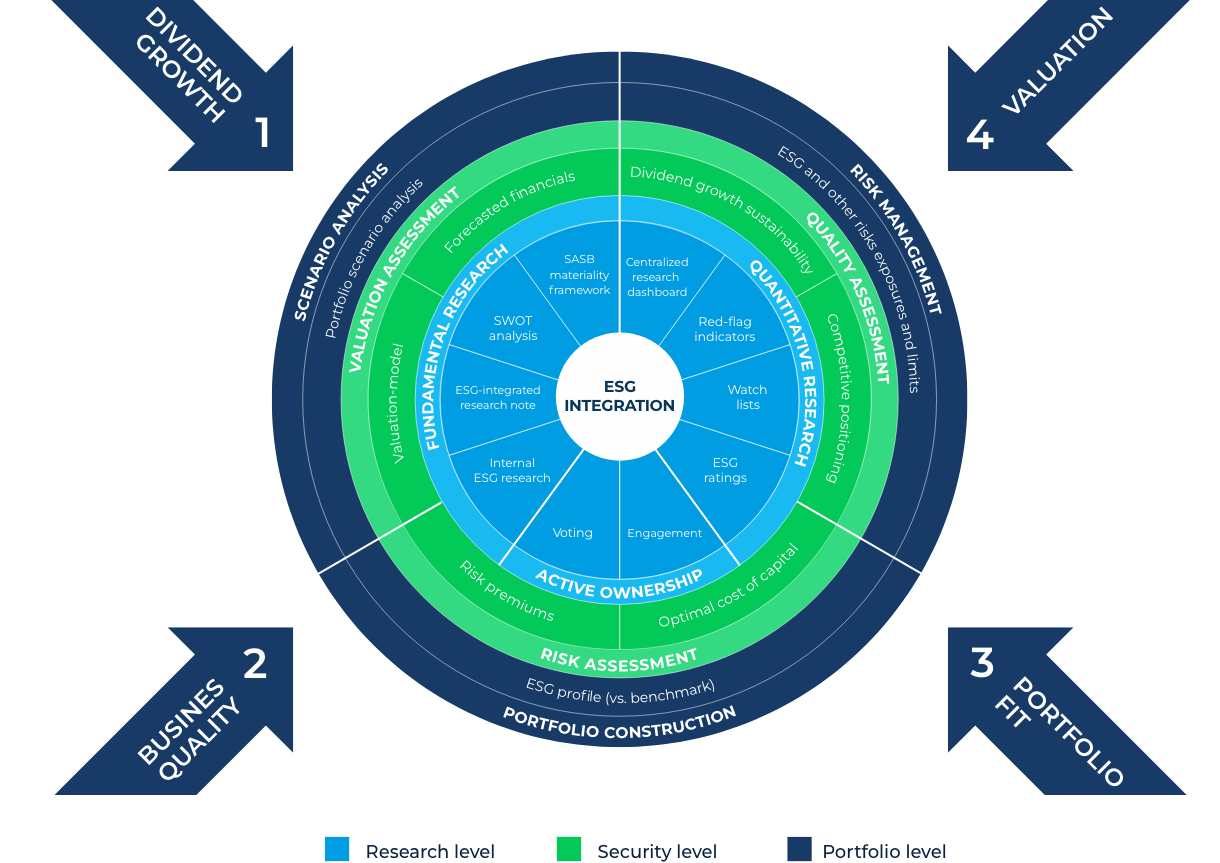

Bristol Gate combines fundamental analysis with a quantitative, machine learning based prediction model to identify companies with the highest predicted dividend growth. Bristol Gate’s investment process has always considered the business risks of each individual security in our portfolio, including a company’s governance practices. By actively trying to assess all risks surrounding our businesses we believe it leads to better long-term risk-adjusted returns. Therefore, formalizing an explicit ESG component within our process was a natural evolution. Our four-pillar portfolio construction framework consists of: 1. Dividend Growth 2. Business Quality 3. Valuation and 4. Portfolio Fit. ESG factors are just one of several inputs considered as part of our assessment of a potential investment and are not a primary determining element in the investment decision making process.

We utilize an ESG integration methodology outlined below that assesses investments with a risk/return lens in mind. Beginning in June 2021, we adopted and adapted frameworks suggested by leading organizations such as the CFA Institute, SASB, and PRI. Certain components of our framework remain in development and we expect that our methodology will continue to evolve over time as we selectively apply all relevant elements to each potential investment. The Materiality map originally developed by SASB is a key component of our fundamental analysis and is used to evaluate relevant ESG risks businesses might face. Consistent with our existing process, we utilize both data and fundamental analysis to evaluate risks on individual securities and the portfolio.

In our framework, no stocks are outright excluded due to ESG considerations, but our ESG assessment can impact the overall thesis on a potential investment, our determination of the Dividend Growth sustainability (1st pillar) and/or Quality of the company (2nd pillar). Additionally, our ESG assessment provides inputs into our cost of capital calculations with lower ranking companies getting a higher cost of capital. This directly impacts our investment decisions through its effect on our determination of company Valuation (3rd pillar). Finally, we aggregate and monitor ESG related exposures at the Portfolio level (4th pillar) to ensure proper diversification on both an absolute level and relative to the strategy’s broader benchmark.

Just as the weight of each of our pillars is not defined, no specific weighting is assigned to any ESG factor and Bristol Gate uses its discretion in determining which ESG factors are relevant when assessing a potential investment. Different ESG factors are considered based on the specific company and the industries and geographies in which it operates. Examples of ESG factors that the investment team may consider include: greenhouse gas emissions, waste and hazardous materials management, diversity and inclusion, workplace health and safety, board composition and executive compensation. This list is not exhaustive. We may also incorporate the use of third party ESG data and ratings to help inform our investment decisions as necessary.

Bristol Gate became a UNPRI signatory in 2020.

Takes 2 minutes

Takes 2 minutes